Your Guide to Islamic Home Financing

Muslims in the U.S. now have a real, riba-free choice for Islamic home finance that is NOT affiliated with riba banks.

The Authentic Halal Mortgage for American Muslims

Today’s homeowners want to feel assured that their home financing matches their values.

Fortunately, Islamic home financing is not only possible, but it’s now just as easy and cost-effective as a conventional mortgage with Guidance Residential.

Fast facts on buying a home the Islamic way:

- Owning a home provides more stability than renting

- Homeownership is a top source of family wealth for generations to come

- Riba is not an option for observant Muslims when an alternative is available

- You need an authentic halal mortgage alternative not backed by a riba-based bank

You can achieve the American Dream the halal way with Guidance Residential!

WATCH NOW

Why We Are Not A Bank

In recent years, some banks in the United States have created what they call Islamic mortgage contracts in an attempt to attract Muslim customers.

Creating an Authentic Islamic Alternative

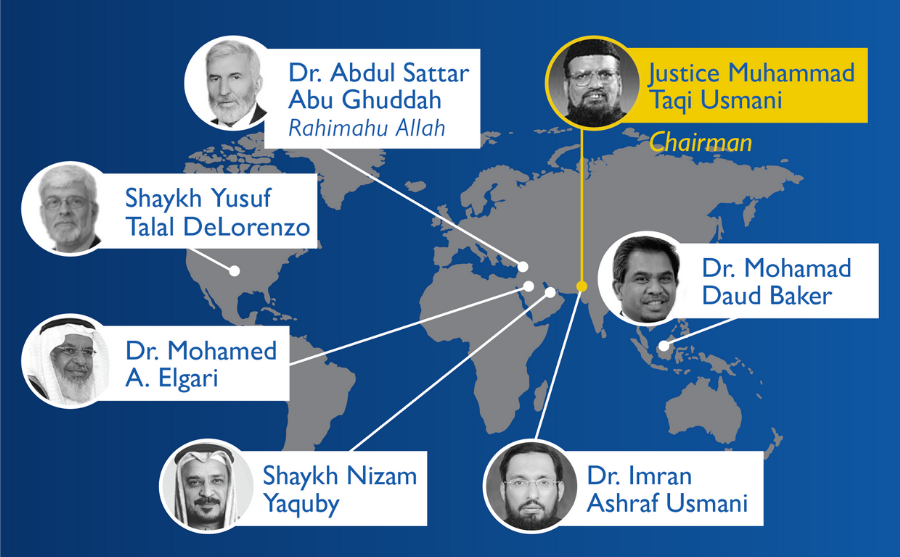

In the 1990s, the founders of Guidance Residential set out to create a true Islamic home financing model for American Muslims.

By the Numbers: Research and Development

- 3 years of research

- 6 top scholars of Islamic finance

- 18 law firms

The result was a ground-breaking solution. It was an authentic Co-Ownership Model of Islamic home finance. It fully complied with shariah law as well as U.S. regulations.

How It Works

When you decide to buy a home, Guidance Residential will buy it together with you as co-owners. We create an LLC for every home purchased.

Over time, you will increase your share through monthly payments, which also include a utilization fee for your exclusive use of the property.

You have full ownership rights from day 1. We share some of the risks, but you retain all of the profit when you sell.

It’s a win-win for our homeowners, and we are proud to provide this service for you.

About Guidance Residential

The Guidance Effect

Today, Guidance Residential has provided more than $10 billion in financing to help more than 40,000 families.

We’re honored to remain the #1 U.S. provider of Islamic home financing.

And we’re here to help you.

2002

Started Operations

34

Licensed States

$10 B+

in Funded Contracts

40,000+

Families Served

150+

Employees & Staff

Frequently Asked Questions

Islamic home finance is completely different from a mortgage loan because it is not a loan at all. Instead of a lender/borrower arrangement, Guidance Residential and the home buyer purchase the home together as co-owners. This creates a much more equitable arrangement that does not involve interest, or riba, which is prohibited in Islam.

Scholars agree that a mortgage loan is not an acceptable way for a practicing Muslim to finance a home. In a loan transaction, the lender provides funds to the borrower in exchange for a repayment of the funds in the future plus interest – essentially selling cash now for more cash in the future. The buyer repays the money with added interest, or riba, which is prohibited in Islam.

To provide an alternative to a mortgage loan, Guidance Residential developed a co-ownership model of Islamic home financing. Rather than lending money to the home buyer, Guidance Residential uses its funds to purchase a share in the property. Guidance and the home buyer purchase the home together as co-owners, a much more equitable arrangement. And no riba is involved.

Watch this video to learn more about the difference between Islamic home finance and a mortgage loan.

Guidance Residential’s Declining Balance Co-ownership Program is based on an Islamic finance concept known as diminishing Musharakah. For every home purchased, we establish an LLC and enter into the contract as partners with the home buyer.

Here’s how it works:

- The home buyer and Guidance Residential agree to be co-owners in the property.

- The two parties buy the home, with the ownership of the property determined by each party's investment.

- The home buyer makes monthly payments to Guidance Residential. One portion of each monthly payment goes toward buying more of our share of the property. The other portion provides you with full usage rights of the entire property.

- Over the course of the arrangement, the home buyer purchases all of Guidance Residential's ownership stake and becomes the sole owner of the property.

The whole time, your name is the one on the property title, and you have the same full rights as any other homeowner in the United States – plus some extra benefits.

Watch this video to learn more about how Islamic home finance works.

A contract that abides by Islamic principles offers much greater protection to consumers than conventional mortgage loans.

- Risk sharing: With a conventional mortgage loan, you are solely responsible for any losses resulting from events like natural disasters or eminent domain. No matter what happens, you bear the responsibility of repaying the entire loan amount. In contrast, with Guidance Residential, as co-owners, we share the risk of any potential loss in proportion to the percentage of the property each party owns.

- Non-recourse commitment: In most traditional loan programs, if the home buyer is unable to continue making their monthly payments, the bank can seize not only the home but also other assets like personal savings accounts, pensions, and college funds. Guidance Residential’s Declining Balance Co-ownership Program, on the other hand, has a non-recourse clause. This means that if you default, Guidance Residential will not pursue your other assets. You are only at risk for the equity you have in the property.

- No pre-payment penalty: Banks have traditionally levied a pre-payment penalty on customers who wish to pay ahead of schedule and pay off their home earlier than the contract time period stipulates. Guidance does not charge any pre-payment fee — you can fully buy out Guidance’s share at any time with no penalty.

- Capped late fees: Banks typically charge a hefty fee (5% of the monthly payment) to customers who make their payments late. For example, on a $3,500 monthly payment, banks will charge $175. In this example, the bank is profiting from someone’s hardship. Guidance Residential would only charge a $50 fee, which covers the administrative costs, to remind the customer of their overdue payment. Central to our model is the belief that we should not profit from someone else's hardship.

With Guidance Residential, you need not worry about worst-case scenarios. We share in the risks of home ownership, offering a consumer-friendly approach that upholds timeless values.

Read more about the additional benefits of our program.

No, several models of Islamic home finance are available. Guidance Residential developed its program based on the Musharakah approach, which is the one that is most preferred by leading scholars.

These are the three main options for Islamic home finance:

- Musharakah: The home buyer and the financier purchase the home together as co-owners, and the homeowner gradually buys out the financier's share of the property. This is the preferred method in the United States and the approach Guidance Residential uses.

- Ijara: This is a lease-to-own arrangement. In this arrangement, the benefits of homeownership are deferred until payment is complete, which can be a risky option.

- Murabaha: The financier buys the home and sells it to the customer on a deferred basis at an agreed-upon profit. This is not a loan with interest — it is a resale with a deferred fee. However, it creates an obligation that resembles debt.

Diminishing Musharakah has been deemed by the most highly respected scholars in Islamic finance as the best option, and it is the approach taken by Guidance Residential since inception in 2002.

Read more about the three types of Islamic home finance.

In recent years, some banks in the United States have created what they call Islamic mortgage contracts in an attempt to attract Muslim customers. This leads some home buyers to wonder if an Islamic mortgage through a bank is a good alternative.

The answer is no — a bank in the U.S. is still a bank, and its products are problematic for customers trying to follow Islamic principles.

Shariah law strictly prohibits the practice of riba, which is the lending and borrowing of money at interest. The use of interest is at the heart of a U.S. bank’s business practice, and it is how they earn their income. Banks convert cash deposits into debt, selling more debt through credit cards or loans. Financing a home through a bank or subsidiary of a bank means supporting ventures prohibited by Islam.

Guidance Residential, on the other hand, is not a bank, and the income that we use to help purchase your home is earned in a halal manner. U.S. banking laws actually prevent banks from investing in and owning real property, making it impossible for them to become a co-owner and set up an LLC as Guidance Residential does.

The esteemed Assembly of Muslim Jurists of America (AMJA) has passed a resolution naming Guidance Residential and our Declining Balance Co-ownership Program as a “permissible’’ path to Muslim Americans in need of home financing. The contract was found to be “sound in general.” Others who happened to be subsidiaries of banks were either regarded as companies that the Muslim public “is not allowed to deal with’’ or can deal with “only if one is in a state of dire need,’’ adding, “whoever remains away from them has kept himself safe and has protected his faith and honor.”

As a wholly-owned Muslim organization, Guidance Residential was structured as a financial services company — not as a bank nor a subsidiary of a bank.

Guidance Residential is the only non-bank and riba-free financing provider approved by an independent Shariah board, giving you the confidence that you can buy a home without compromising your values.

Watch this video to learn more about how Guidance is different from a bank and how an LLC makes all the difference.

Although Guidance's program is distinctly different in the methodology of facilitating home ownership, it still needs to be competitive with conventional pricing models.

Unlike mortgage lenders who charge interest from money lent, Guidance charges a profit payment or usage fee for permitting the home buyer to occupy a portion of the property still owned by Guidance. Since home buyers expect a shariah-compliant alternative be competitive to a conventional mortgage loan, the usage fee was indexed against prices in the conventional home financing market.

Scholars of Islamic finance have determined this practice to be permissible because pricing does not change the nature of the contract.

Watch this video to learn more about how Guidance Residential sets its prices.

Awards & Recognition

Why Our Customers Love Us

We have a collection of frequently asked videos that will answer any questions you may have about Guidance.

.png?width=1200&length=1200&name=MASCON_Google%20Review%20Banner%20for%20Landing%20Page%20(1).png)

.png?width=1200&length=1200&name=MASCON_Google%20Review%20Banner%20for%20Landing%20Page%20(1).png)

Get Started on Your Islamic Home Financing Journey

Thinking about buying a home? Or want to refinance your current mortgage to us? We’re here to help.

.jpg)